Unlock Your Potential

Explore Exciting Careers at BankVista!

{beginAccordion}

Open Positions

Are you passionate about providing exceptional financial services and eager to make a meaningful impact in your community? BankVista is looking for dedicated and talented individuals to join our team. As a member of BankVista, you'll be part of a dynamic and supportive environment where innovation, collaboration, and professional growth are highly valued. We offer competitive benefits, opportunities for advancement, and a chance to be part of a company that truly cares about its employees and clients. If you're ready to take your career to the next level, apply today and become a vital part of the BankVista family!

RELATIONSHIP BANKER - MANKATO, MN | Full-Time

BankVista is seeking an experienced Relationship Banker with prior retail and business banking experience to join our Mankato team. This role is designed for professionals who have already worked in a financial institution and are confident managing consumer and business client relationships, opening accounts, and advising on banking products.

About BankVista

At BankVista, we believe strong client relationships are built by knowledgeable, experienced professionals. Our team works in a collaborative, high-performance environment that values accountability, expertise, and exceptional service. We offer competitive compensation, strong benefits, and long-term career growth for banking professionals who want to make a meaningful impact in their communities.

Position Summary

The Relationship Banker serves as a primary point of contact for consumer and business clients, managing daily banking needs and proactively identifying opportunities to deepen relationships. This role requires a working knowledge of consumer and business deposit products, confidence in advising clients, and the ability to independently handle account-related requests with accuracy and professionalism.

Primary Responsibilities

- Open and service consumer deposit accounts, including Checking, Savings, Certificates of Deposit, IRAs, HSAs, and Safe Deposit Boxes

- Support business account onboarding, including deposit accounts, debit cards, and treasury-related services

- Cross-sell appropriate bank products based on client needs and financial goals

- Process complex account requests such as stop payments, wire transfers, telephone transfers, check orders, and special account instructions

- Perform daily account transactions, maintenance, and client correspondence with accuracy and regulatory compliance

- Conduct proactive follow-up with existing clients to ensure satisfaction and identify future needs

- Partner with Treasury Management Officers on business client relationships

- Represent BankVista professionally within the local community

Required Qualifications (Applicants Must Meet These Requirements)

- Minimum of two (2) years of recent experience in retail and/or business banking

- Demonstrated experience opening and servicing consumer and business deposit accounts

- Proven track record of delivering high-quality client service in a financial institution

- Ability to confidently discuss and recommend banking products based on client needs

Preferred Experience

- Experience with treasury management products and/or consumer lending

- Prior experience using Fiserv Premier or a similar core banking system

Compensation & Benefits

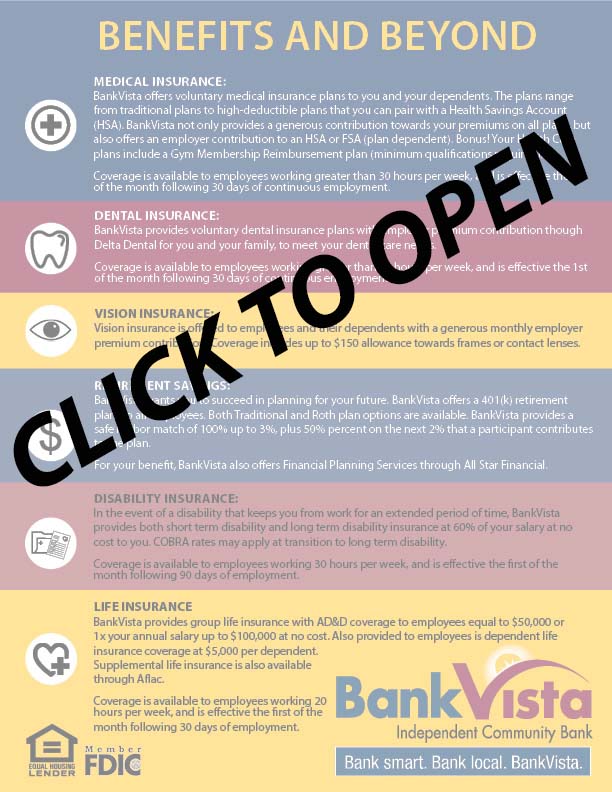

BankVista offers a competitive salary and comprehensive benefits package, including:

- Health, dental, and vision insurance

- Employer-paid life insurance and disability coverage

- 401(k) plan with employer match

Salary: $24-$32 DOE

COMMERCIAL LOAN SPECIALIST- SARTELL, MN

The Commercial Loan Specialist plays a critical role in supporting the bank’s commercial lending operations by ensuring accurate processing, closing, and ongoing servicing of Commercial and SBA loans. This position partners closely with Commercial Loan Officers and the SBA Closing Officer to deliver exceptional administrative support throughout the loan lifecycle. Key responsibilities include preparing and reviewing commercial loan documentation, maintaining compliance with regulatory and internal standards, and managing the integrity of commercial and SBA loan files. The Specialist ensures timely and precise execution of loan transactions, contributing to a seamless client experience and the overall success of the lending team.

Primary Job Responsibilities

-

Prepare accurate and complete documentation for Commercial and SBA loans, ensuring compliance with credit presentations and SBA Terms and Conditions. Disburse loan proceeds in accordance with approved terms.

-

Serve as a primary point of contact for clients in person and by phone, addressing inquiries related to Commercial and SBA loans. Proactively gather required documentation and coordinate all aspects of loan closings for a seamless client experience.

-

Prepare and submit SBA applications through Etran, ensuring timely and accurate processing.

-

Order and review third-party vendor items—including title work, flood determinations, tax transcripts, UCC lien searches, and character searches—to confirm alignment with credit presentations, bank policies, and SBA guidelines.

-

Examine purchase agreements, leases, organizational documents, and insurance policies for completeness and compliance with internal and SBA standards.

-

Maintain organized and compliant loan files by scanning documentation into M-Files, updating ticklers, and verifying file integrity.

-

Assist with Commercial and SBA loan servicing requests, including subordinations, collateral releases/substitutions, loan increases, renewals, and payoff processing.

-

Notify and obtain SBA approvals for servicing requests in accordance with SBA Standard Operating Procedures.

Essential Qualifications and Requirements:

-

Associate’s degree in business, finance, or related field required; Bachelor’s degree preferred.

-

2+ years of experience in commercial loan processing or servicing; SBA experience strongly preferred.

-

Knowledge of commercial loan documentation, regulatory compliance, and banking policies.

-

Proficiency in Microsoft Office Suite; experience with LaserPro and M-Files preferred.

Pay: From $24.00 per hour

Apply by emailing your resume to [email protected]

Equal Opportunity Employer

BankVista is committed to providing an environment that is free from discrimination and harassment based on race, age, creed, color, religion, national origin or ancestry, sex, gender, disability, veteran status, genetic information, sexual orientation, gender identity or expression, or pregnancy and will not discharge or in any other manner discriminate against employees or applicants because they have inquired about, discussed, or disclosed their own pay or the pay of another employee or applicant. BankVista is an equal opportunity/equal access/affirmative action employer fully committed to achieving a diverse workforce and complies with all Federal and Minnesota State laws, regulations, and executive orders regarding non-discrimination and affirmative action.

BankVista At a Glance

Founded: 2000

Primary Business: Small Business Lending & Deposits

Headquarters: BankVista, Sartell, MN

Locations: Sartell, MN | Mankato, MN | Chaska, MN

Employees: 70+

Review Our Benefits

With BankVista, can unlock a world of opportunities and incentives! Discover the variety of outstanding advantages available from BankVista in the leaflet below.

{endAccordion}

Contact BankVista Human Resources View Our Awards

BankVista is committed to providing an environment that is free from discrimination and harassment based on race, age, creed, color, religion, national origin or ancestry, sex, gender, disability, veteran status, genetic information, sexual orientation, gender identity or expression, or pregnancy and will not discharge or in any other manner discriminate against employees or applicants because they have inquired about, discussed, or disclosed their own pay or the pay of another employee or applicant. BankVista is an equal opportunity/equal access/affirmative action employer fully committed to achieving a diverse workforce and complies with all Federal and Minnesota State laws, regulations, and executive orders regarding non-discrimination and affirmative action.